Tinubu Launches Personal Income Tax Calculator Ahead of 2026 Reforms President Bola Ahmed Tinubu has unveiled a new Personal Income Tax Calculator designed to help Nigerians understand how much they will pay under the tax reforms his administration recently signed into law. The tool, launched on Friday and shared via the president’s official X

Tinubu Launches Personal Income Tax Calculator Ahead of 2026 Reforms

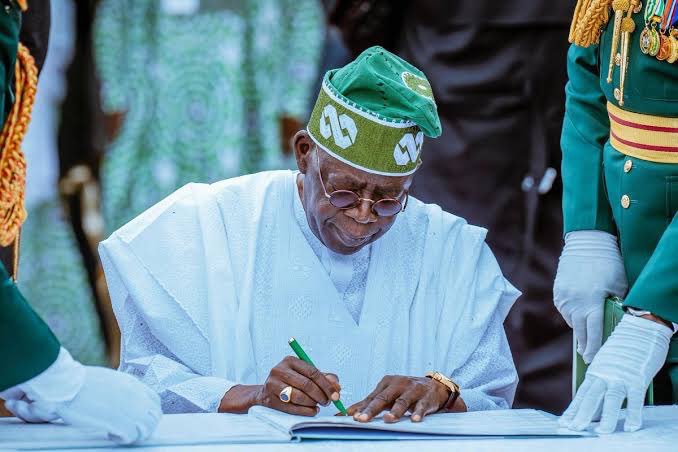

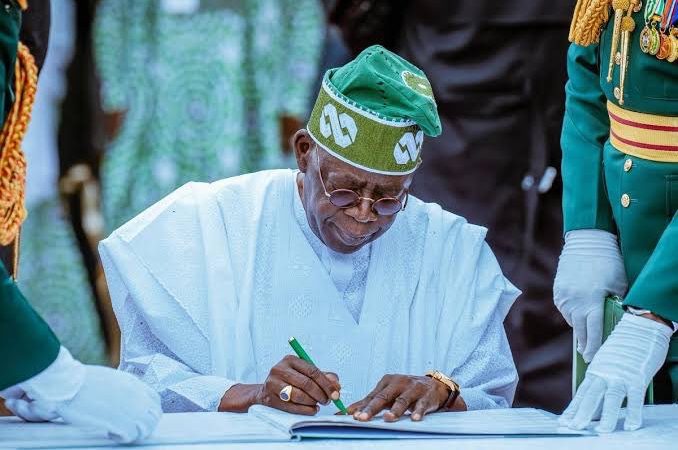

President Bola Ahmed Tinubu has unveiled a new Personal Income Tax Calculator designed to help Nigerians understand how much they will pay under the tax reforms his administration recently signed into law.

The tool, launched on Friday and shared via the president’s official X (formerly Twitter) handle, allows individuals to compare their current tax rates with the revised system that comes into effect in January 2026. According to Tinubu, the initiative is part of efforts to build a fairer, more transparent tax system that protects low-income earners.

Muslim-Muslim Ticket: ‘Only Death, Serious Health Issues Can Stop Tinubu’s Re-election’ – Ojo

Tinubu’s Call for Transparency in Taxation

In his announcement, President Tinubu emphasized that taxation must not become a burden on the poor or vulnerable. He stated that the newly introduced tax laws were structured to ensure equity and fairness in line with his administration’s economic renewal agenda.

“A fair tax system must never punish poverty or weigh down the most vulnerable,” Tinubu said.

“With the new tax laws I recently signed, taking effect from January 2026, we have lifted this burden and created a path of equity, fairness, and true redistribution in our economy.”

The Personal Income Tax Calculator, accessible at fiscalreforms.ng, gives citizens the ability to estimate their future tax obligations. It also provides side-by-side comparisons, showing how the reforms aim to reduce pressure on lower-income brackets while improving compliance and progressivity.

Protecting Low-Income Earners

The President noted that the reform is designed to simplify Nigeria’s tax compliance system while safeguarding those at the bottom of the income ladder.

“It shows clearly how these reforms protect low-income earners, ensure progressivity, and simplify compliance in order to deliver a transparent system that works for all,” Tinubu explained.

He reassured Nigerians that the reforms are not just about raising revenue but about achieving economic justice. By redistributing the tax burden more fairly, his administration aims to create an environment where citizens feel confident about their contributions being used for national development.

Renewed Hope Agenda and National Confidence

Beyond the technical details, President Tinubu used the tax reforms to reinforce his Renewed Hope Agenda, urging Nigerians to maintain faith in the country’s economic future.

“Together, we are renewing hope in the Nigeria of our dreams,” he said. “Take a bet on our country. Bet on Nigeria to work for you, your family, and your community.”

The introduction of the Personal Income Tax Calculator reflects the government’s attempt to engage citizens directly, making policies accessible and understandable. It also aligns with broader fiscal reforms intended to expand Nigeria’s tax base, reduce over-reliance on oil revenues, and create a more sustainable economy.

A Step Towards Accountability

Economic experts have long argued that Nigeria’s tax system needs modernization, particularly to address loopholes, widen compliance, and ensure fairness across income groups. Tinubu’s government has presented this new tool as a demonstration of transparency—enabling Nigerians to see for themselves the practical effects of fiscal policy on their earnings.

As the reforms approach their January 2026 implementation date, citizens are expected to familiarize themselves with the system and prepare for adjustments in compliance procedures.

The success of the reforms, however, will likely depend on their execution and whether Nigerians feel the promised fairness translates into real relief for the most vulnerable households.

For now, Tinubu’s message is clear: the new tax structure is intended to lighten the burden on low-income earners while creating a transparent system that strengthens Nigeria’s fiscal future.

Leave a Comment

Your email address will not be published. Required fields are marked with *