The Hidden Cost of USSD: How Nigerians Are Losing Money to Failed Bank Transactions When **Chinyere**, a petty trader in Lagos, attempted to transfer ₦5,000 to her supplier using her bank’s USSD code, she assumed it would take only a few seconds. Instead, the transaction failed midway. Frustrated, she tried again. The second attempt

The Hidden Cost of USSD: How Nigerians Are Losing Money to Failed Bank Transactions

When **Chinyere**, a petty trader in Lagos, attempted to transfer ₦5,000 to her supplier using her bank’s USSD code, she assumed it would take only a few seconds. Instead, the transaction failed midway. Frustrated, she tried again. The second attempt also collapsed, yet ₦6.98 was deducted from her airtime for each attempt. At the end, she lost **₦13.96** without completing her transfer.

Her story is far from unique. Across Nigeria, bank customers relying on USSD codes for financial transactions have continued to face failed sessions, double charges, and little or no recourse for refunds. This silent financial drain has become a hidden cost of banking for millions of people, particularly those in rural areas who rely heavily on USSD because of limited access to internet-enabled devices.

A Threat to Financial Inclusion

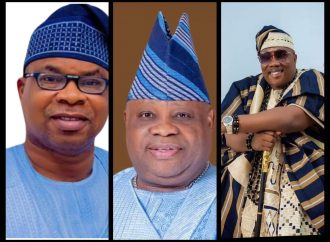

According to the **National Vice President of the Association of Mobile Money and Bank Agents in Nigeria (AMMBAN)**, **Mr. Yusuf Adeyemo**, the persistent failure of USSD transactions is now undermining Nigeria’s financial inclusion drive.

He explained that while point-of-sale (POS) agents may be less affected due to their reliance on terminals, everyday customers are losing money on unsuccessful USSD sessions.

“Some people may think ₦6.98 is insignificant. But when a person is charged multiple times for failed sessions, it becomes a heavy financial burden. This is discouraging people from keeping their money in banks and threatening financial inclusion,” Adeyemo warned.

He added that many customers have been debited for something as simple as checking their BVN or retrieving their NIN without actually receiving the service. For him, affordability is the foundation of financial inclusion, and when transactions become costly and unreliable, trust in the system erodes.

Banks or Telcos: Who Should Be Blamed?

The blame game between banks and telecom operators has only deepened customer frustrations.

With the introduction of **end-user billing** in June 2025, telecom operators began deducting USSD charges directly from customers’ airtime, rather than banks removing it from their accounts. The move, according to the **Association of Licensed Telecommunications Operators of Nigeria (ALTON)**, was meant to resolve years of debt disputes between banks and telcos.

**ALTON Chairman, Engr. Gbenga Adebayo**, defended the telcos, arguing that operators provide the infrastructure to connect customers to banks but cannot control what happens afterward.

“Operators deliver you to the infrastructure of the bank. Whether you get money from the bank or not is not the fault of the telcos. Sometimes, bank servers fail, just like ATMs that have no money. You can’t blame your driver for taking you to the bank when the ATM is empty,” Adebayo explained.

On the other hand, a bank official speaking anonymously insisted the new billing system makes it difficult to hold banks responsible. He admitted that while banks occasionally face technical issues, they continue to invest heavily in digital infrastructure to improve efficiency.

“How can you blame the banks for money they are not collecting? Telcos are the ones directly deducting the charges from customers now,” he argued.

Customers Bear the Brunt

For consumers like Chinyere, the finger-pointing is of little comfort. With no clear system for refunds or dispute resolution, customers are forced to bear the hidden costs of USSD failures in silence.

**Mr. Elvis Eromosele**, Editor of *TheNumbersNG*, who has also suffered debits from failed USSD transactions, believes the telcos must take greater responsibility. He argues that charges should only apply when a transaction is successfully completed.

“The telcos must auto-refund airtime where a session fails, just as banks issue reversals for failed transactions. The NCC must also compel them to set up user-friendly dispute resolution platforms with strict timelines for refunds,” he said.

Eromosele also criticised the lack of public awareness about the new end-user billing model, noting that many Nigerians are unaware of how the charges work or how to seek redress.

Regulatory Intervention on the Horizon

A source at the **Nigerian Communications Commission (NCC)** confirmed that the regulator is aware of the complaints and is considering measures to address the issue. Although the source did not provide details, it suggested that modalities would soon be rolled out to ensure customers are not unfairly charged for failed sessions.

The NCC, alongside the **Central Bank of Nigeria (CBN)**, was instrumental in approving the shift to end-user billing in June 2025. The policy was designed to settle long-standing disputes between banks and telcos, but it has inadvertently transferred the burden of inefficiencies onto customers.

The Way Forward

To restore public confidence in USSD transactions, experts have outlined several key steps:

1. **Charge on Success Only** – USSD fees should only apply after transactions are successfully completed.

2. **Auto-Refund Mechanisms** – Failed or incomplete sessions must trigger instant refunds, just as with failed ATM or POS transactions.

3. **Customer Dispute Resolution** – Telcos should create simple, time-bound platforms for users to lodge complaints and receive quick resolutions.

4. **Public Awareness Campaigns** – Customers must be educated about the billing changes, how USSD charges work, and how to report failed sessions.

5. **Joint Regulatory Oversight** – Both NCC and CBN must collaborate to ensure accountability from both banks and telcos.

For millions of Nigerians, USSD remains the cheapest and most accessible channel for financial transactions. However, the growing issue of **hidden costs from failed sessions** risks reversing the progress made in financial inclusion.

Chinyere’s experience mirrors that of countless others across the country—citizens forced to pay for services they never received. Unless regulators and stakeholders act quickly, the trust gap between Nigerians and the financial system will only widen, pushing more people back into cash-only transactions.

At a time when Nigeria seeks to expand digital banking and reduce cash dependence, ensuring that **USSD is affordable, reliable, and transparent** is not just a matter of convenience, but a national priority.

Leave a Comment

Your email address will not be published. Required fields are marked with *